The Truth Hurts – Conservative Opinions

There is a gentleman

out in Colorado

who authors a blog called Mr. Money

Mustache. His thing is that if a person

or family saves a lot, is very careful with their money and doesn’t spend their

income on useless unneeded things the person or family can retire very early with

a nice investment portfolio that produces a very comfortable income.

Of course Mr.

Mustache is not typical. He has the skills and experience to build a house,

repair a car and do all sorts of things that the average person just cannot do.

He also leads a healthy lifestyle. But his philosophy is sound. His health insurance is a high deductible

($10,000) plan, but he has to change with health care reform. Here

are his conclusions.

Obamacare: Friend of the Entrepreneur

and Early Retiree . . .

So we would be doubling our

premiums, but cutting the deductible in half, as well as gaining prescription

drug coverage (a $20 copay after deductible) and some other goodies. And the

new plan is HSA-eligible, which means all costs will be covered with pre-tax

money. More insurance for more money – not my favorite bet to make, but also

not completely devoid of value.

But wait, there is more. His premiums do not double. There are generous subsidies under health

care reform!

When you select a 2014 plan,

a little box pops up: “check if you are eligible for a subsidy on this plan”.

Working through the options, here is what I see for my own family:

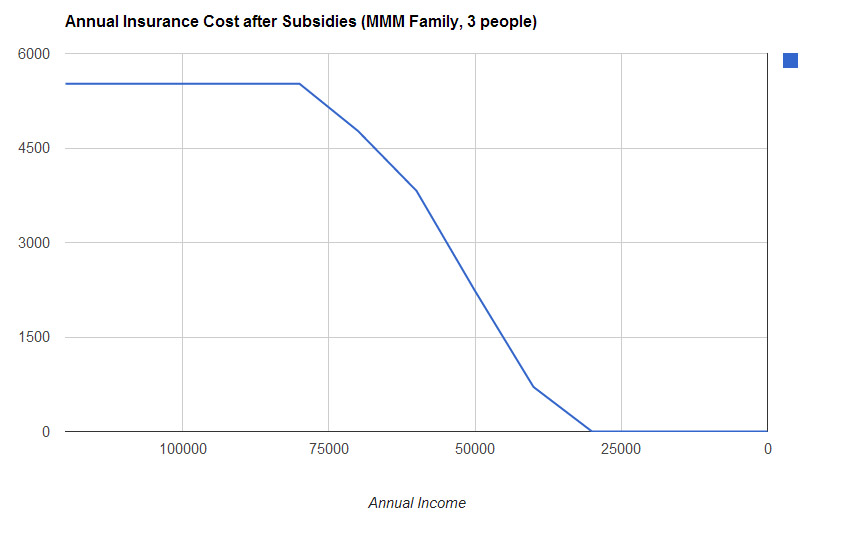

Whoa. So although I could

pay a maximum of

$5520 per year for this new and improved coverage, in reality I will only pay

this much in years where my annual income is over $80,000. For incomes below

that generous level, the federal subsidy kicks in and my net cost drops, until

I get to the point of free health insurance somewhere around $26,000. With annual living expenses of about $25,000, we could in theory structure our investments

such that we live the current lavish lifestyle and get fully subsidized health insurance simultaneously**.

** Unfortunately, I have to admit

that this year we will have a household income above $80,000 and thus would not

be eligible for a subsidy. Higher-than-forecast investment and Lending

Club returns, rental house, carpentry, and real estate income plus this

blog have all contributed to this. Please don’t tell the Early

Retirement Police. If this

terrible condition persists into 2015 and we are kicked into a new plan, I

guess we will have to settle for a slightly lower savings rate. What an

oppressive country!

As for difficulties in signing up, well his

experience is this.

*Wow, I notice that the

healthcare.gov site is snappy and fast now. Despite widespread controversy in

the news about the supposedly catastrophic launch of this new website.

Again the Low Information Diet prevails: stay calm, tune out of 24-hour-news cycle talking heads controversy, check site again a few weeks after launch, get health insurance quotes quickly.

Again the Low Information Diet prevails: stay calm, tune out of 24-hour-news cycle talking heads controversy, check site again a few weeks after launch, get health insurance quotes quickly.

Well don’t expect that to be reported by the press,

it doesn’t fit the script that health care reform is a disaster.

No comments:

Post a Comment