And Why You Won’t Either If You Continue Reading

Lost amidst the furor over deficit reduction, raising taxes by lowering them, cutting spending and increasing the debt ceiling is that the U. S.

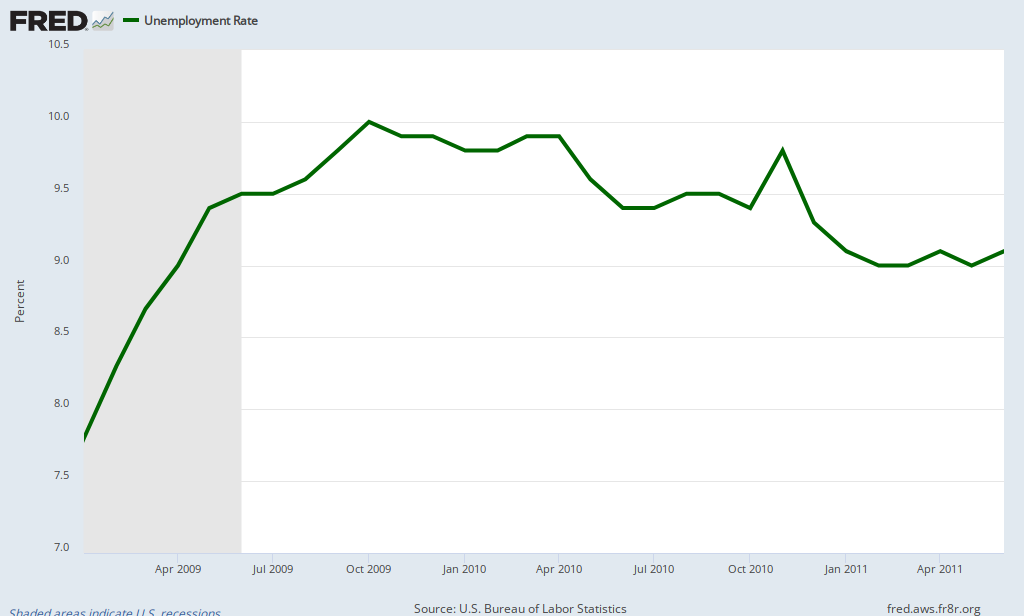

Unemployment Rate:

This graph shows how the unemployment rate from the beginning of the Obama administration. The rise during the first year of Mr. Obama’s presidency was the result of Bush era economic conditions. The much slower decline occurred with the stimulus package enacted to rescue the economy. The most recent trend is a slight uptick in the unemployment rate

This graph shows how the unemployment rate from the beginning of the Obama administration. The rise during the first year of Mr. Obama’s presidency was the result of Bush era economic conditions. The much slower decline occurred with the stimulus package enacted to rescue the economy. The most recent trend is a slight uptick in the unemployment rateRetail Sales:

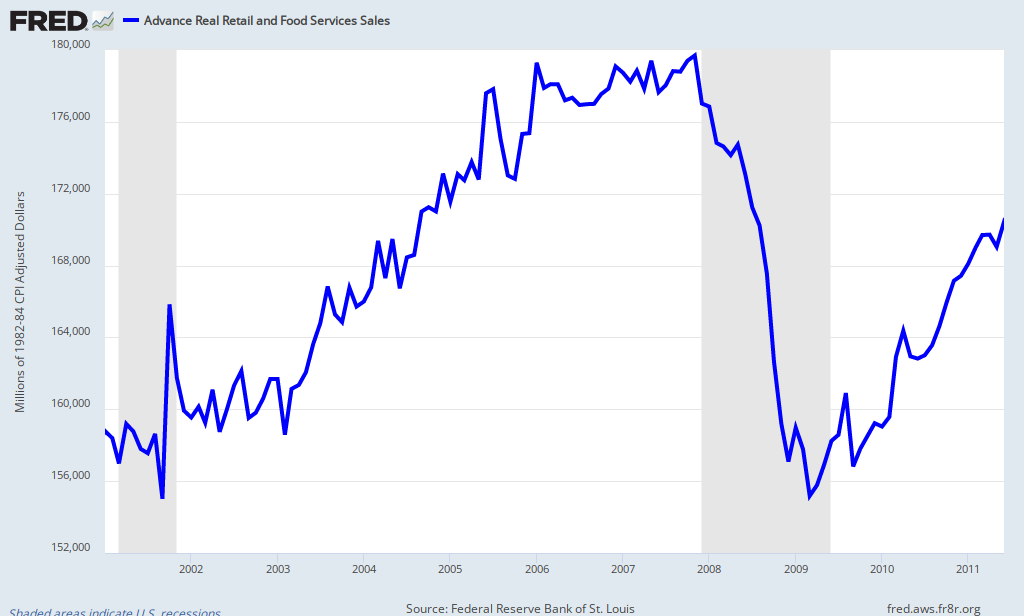

The increase in real retail sales is shown from the beginning of the Bush Presidency to the current date. The recovery in retail sales started with Obama Administration (the contrast with the unemployment rate showing the lag between increased economic activity and increased hiring). Of concern is the little blip at the end, where the curve is flattened.

The increase in real retail sales is shown from the beginning of the Bush Presidency to the current date. The recovery in retail sales started with Obama Administration (the contrast with the unemployment rate showing the lag between increased economic activity and increased hiring). Of concern is the little blip at the end, where the curve is flattened. Real Personal Income:

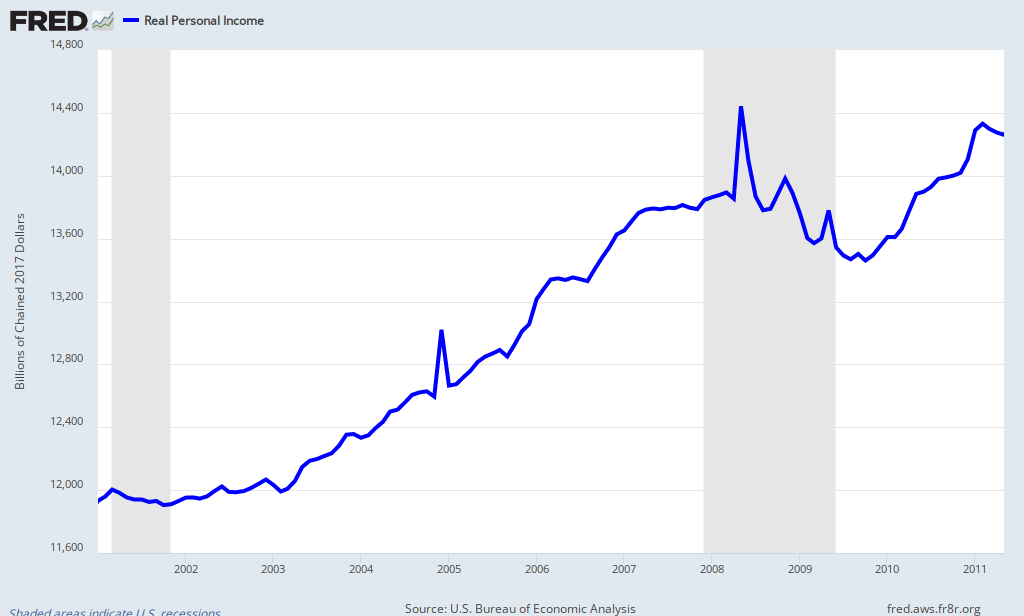

The graph shows real personal income from the start of the Bush Presidency to the present. Notice the fairly pronounced flattening of the curve in recent months. The problem, if real person income is not growing, then retail sales are not going to be able to grow and the unemployment rate will not decline.

What It Means:

The economy has stalled out. The growth engine has shut down. If the stall does not correct itself in the next several month, expansionary fiscal policy is needed, primarily increased government spending on job creating projects.

In short, just exactly the opposite of what the Obama Administration and the Congess are planning to do.

Good luck with that.

No comments:

Post a Comment