One of the great

public services that the opinion/commentary pages of the Wall Street

Journal does is to allow Conservative economists who are pandering to

Republican Presidential nominee Mitt Romney to expose their ignorance. In the latest example of this we have two men

who, incredibly, have Ph. D.’s in economics explaining

how Mitt Romney is going to create jobs.

The key, according to former Senator and Ph. D. economist Phil Gramm and

Glenn Hubbard, Dean of the Columbia School of Busienss is corporate profits.

Glenn Hubbard

Economist

Here is the gist of their argument, in their own words.

In a recent criticism

of Mr. Romney's experience as CEO of the private-equity firm Bain Capital, Mr.

Obama said the president's job is "not simply to maximize profits."

He warned, "if your main argument for how to grow the economy is 'I knew

how to make a lot of money for investors,' then you're missing what this job is

about." But aren't private-sector jobs generated by profits?

Jobs are sustainable

only when profits are sustainable. The American economy was built on the profits

earned by serving consumers, and it will only be saved by earning profits. The

president apparently does not understand that basic point.

This has kind of a nice ring to it, doesn’t it. And it certainly sounds reasonable, after all

profits provide both the incentive and the funding for business investment and

additional hiring. So what’s the

problem, why does The Dismal Political Economist heap such scorn on these two

revered and intelligent men?

Okay, let’s put it in

a way that even Mr. Gramm and Mr. Hubbard can understand, i.e., a picture

because apparently actual data is too difficult for them.

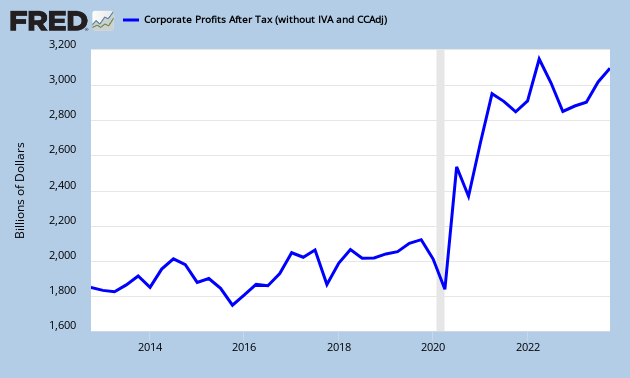

That’s right, in 2009

when Mr. Obama took office corporate profits had plunged to near 2001

levels, thanks in large part to policies of George W. Bush. Now everyone look closely at what corporate

profits have done since Mr. Obama took office.

That’s right, corporate profits plunged in the latter years of the Bush administration and have since rebounded to an almost uninterrupted streak upward, to a level where

they are almost triple where they were at the beginning of Mr. Obama’s term.

So in taking Mr.

Obama to task for not supporting corporate profitability Mr. Gramm and Mr.

Hubbard show that they are just plain ignorant of the data. But more importantly the chart shows the

utter fallacy of their argument. If

large and rising corporate profits were the key to job creation, then given the

record of the Obama administration and the experience of corporate profits the U. S.

should be a job creating mecca. That it

is not can only mean that the position of Mr. Gramm and Mr. Hubbard, and by

extension Mr. Romney is just completely and totally and utterly false.

But don’t show them the

data or this chart, it will only confuse them.

This is very good statistic. !!!

ReplyDeleteAdd to this the information from Moody Analytics that corporate profitability in non-financial firms has reached 15%, the highest level since the 1960's, and you have only one conclusion to reach about Hubbard and Gramm. They begin with a desired political ideology and then attempt to force fit an economic philosophy around it.

ReplyDeleteThanks for sharing this post.

ReplyDeletecrowd funding